Gold and Silver Price Drop?

The “Success Drop”: Will Gold and Silver Replicate the 2025 Iran Reversal?

Gold and Silver Price Drop?

The dawn of 2026 has brought a massive geopolitical shock: Operation Absolute Resolve.

Gold and Silver Price Drop?

The Standard Play: The Initial Gap-Up

Market consensus from firms like Ya Wealth suggests that gold and silver will open significantly higher.

The “Midnight Hammer” Precedent

However, seasoned traders are looking back to June 2025 and the U.S. strikes on Iranian nuclear facilities, known as Operation Midnight Hammer.

The Trap: Gold gapped up 1% at the open as headlines flashed.

The Realization: As news surfaced that the operation was a surgical success with minimal follow-up conflict, the “fear premium” evaporated within hours.

The Reversal: Gold and silver didn’t just flatten; they dropped. By the afternoon, gold had retreated below its Friday close. Investors realized the “threat” was resolved, and profit-taking took over.

Why 2026 Could See a “Success Drop”

There is a strong case to be made that if Operation Absolute Resolve is viewed as a completed “snatch-and-grab” rather than the start of a protracted war, precious metals may face a sharp correction:

Resolution of Uncertainty: Markets price in the possibility of conflict. Once the regime has been toppled and the leader captured, the “unknown” factor that drives gold prices is largely removed.

Profit Taking at Record Highs: Gold and silver entered 2026 after a historic 70% rally in 2025.

Many institutional holders have been waiting for a high-volume “liquidity event” to exit their positions. A successful military operation provides exactly that. The Dollar Factor: Historically, when the U.S. demonstrates decisive military capability, the U.S. Dollar often strengthens. A surging dollar creates a natural headwind for gold and silver, potentially forcing prices down even as the headlines remain focused on Caracas.

What to Watch for on Monday

The key for Monday’s trade will be sustainability. If gold gaps up to $4,380 or $4,400 but fails to hold those levels through the first two hours of the New York session, it may signal that the “Midnight Hammer” pattern is repeating. In this scenario, the “success” of the mission becomes a bearish signal for metals, as the world moves from “fear mode” back to “business as usual.”

Gold and Silver Price Drop?

#######

Visit our gold prospecting site to view of collection of natural gold nuggets,

silver and many other unique precious metals collectibles and great gift ideas:

https://california-gold-rush-miner.us

A few examples from our site:

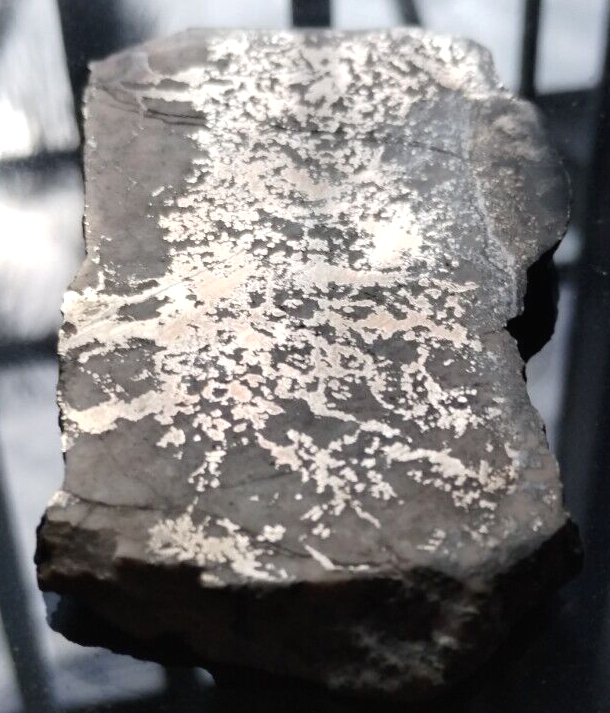

High Grade Silver Ore Slab

silver slab – example only

Nice sawn vein specimen of fresh, unaltered high grade silver ore from the world-class Cobalt Ontario deposits. Sawn on one side only. The deposit was described in Mineralogical Record, Volume 43, Number 6. In general, veins are predominantly composed of carbonates (calcite and/or dolomite) with arsenides and sulpharsenides of Co, Ni and Fe with native Ag and Bismuth. Most of this material has been squirreled away in collections by now, although specimens do occasionally come to market.

There are a few of these silver slabs available. The very bright silver really makes this piece stand out, but, unfortunately makes it all so hard to photograph. As an example the one pictured above is 66 grams for $85.

Silver, Bornite

There are a few of these beautiful native silver w bornite specimens available. Here is a 2 inch x 1 inch, Apx. 17.5 grams – Native Silver on Bornite thumbnail specimen from San Martin, Mexico. As an example the one pictured above is 17.5 grams for $120.

Avon Gold Rush Collectible stein

1987 8 1/2” tall San Francisco Gold Rush Handcrafted in Brazil for Avon. Each one of is individually numbered (#32017) this is the last one. $35.

For further information on these: seo711@gmail.com

All the items shown here are very limited and subject to prior sale without notice.

#######

Also see the most expensive type of gold nuggets, the Crystalline Gold Nuggets

Crystalline gold

Subscribe to our Youtube Arizona Gold Prospecting channel

Click Here for great Gold Prospecting Equipment Deals

DISCLAIMER:

Some of the links in this description and in our videos may be affiliate links, and pay a small commission if you use them, but never increase the basic cost. I really appreciate the support. The content in my Youtube videos & blog posts SHALL NOT be construed as tax, legal, insurance, construction, engineering, health & safety, electrical, financial advice, prospecting or other & may be outdated or inaccurate; it is your responsibility to verify all information. I am a not financial adviser. I only express my opinions based on my experiences. Your experience may be quite different. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. You must conduct your own research. There is NO guarantee of gains or losses on any investments. My produced videos are for entertainment purposes ONLY. DO NOT make buying or selling decisions based on these videos. If you need advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer, financial advisor, or the appropriate professional for the subject you would like help with.

- Keep in mind land use and land boundaries are constantly changing, before going to a unknown location you must do extensive research not only into the current weather conditions, access and current land status. Keep In mind private property owners and mining claim owners do not take kindly to trespassers and or claim jumpers. Always follow local laws and regulations related to prospecting and land use. Regulations and restrictions are constantly changing on BLM lands, State lands, National Monuments and tribal lands. It is your responsibility to totally investigate any potential prospecting area prior to heading out. Failure to do so, could not only result in massive fines but also imprisonment and confiscation of all your equipment.

0 Comments