Silver Cost

Silver Cost Paper vs. Physical: The Real Cost of Silver in 2026

Silver Cost

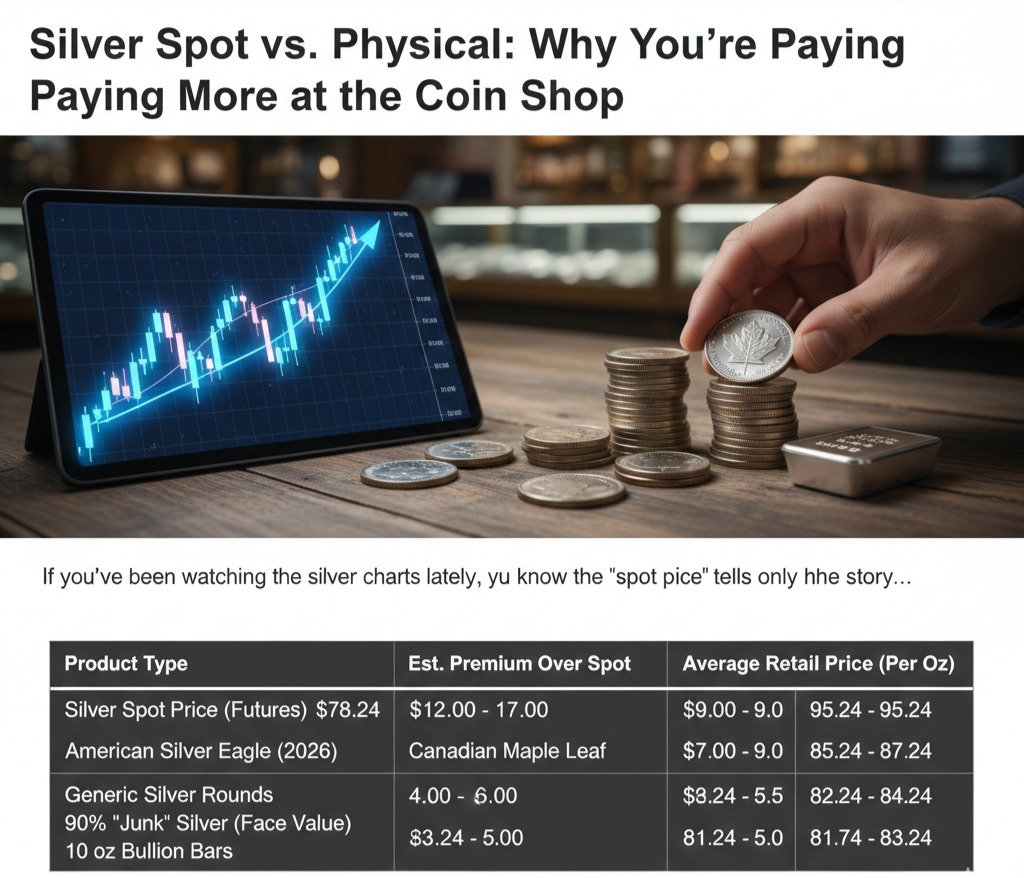

If you’ve been watching the silver charts lately, you know the “spot price” tells only half the story. While the COMEX futures market reflects the digital value of silver contracts, anyone walking into a local coin shop quickly realizes that “spot” is more of a suggestion than a reality.