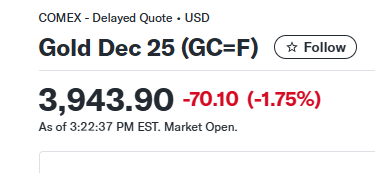

Gold Price @ $2,400

Fantastic interview! Love the quote “Mr Powell has to feel like a porcupine in a balloon factory”.

The conflict in Eastern Europe is likely to be protracted, and energy prices will respond by rallying even higher from current levels, said Pierre Lassonde, chairman emeritus of Franco-Nevada and CEO of Firelight Investments.

“I think that Mr. Putin calculated that this was going to be an easy, quick win for him, to just roll into Ukraine and essentially put Humpty Dumpty back together, which was what he was trying to do. His plans are not turning out exactly as he had wished. With the Germans now changing tack and saying, we’re going to provide military help, that has changed the possible outcome of this war quite dramatically. The longer it lasts, the more profound the impact is going to be, particularly on the energy market. If this goes on for two, three weeks, a month, I think you’re looking at $200 oil,” Lassonde told Michelle Makori, editor-in-chief of Kitco News on the sidelines of the BMO Global Metals & Mining Conference. (more…)