Bitcoin’s Black November:

How the Crypto Crash Compares to Gold’s Stable Rise

The last year has offered a dramatic head-to-head spectacle between the financial world’s most polarizing assets: Bitcoin and Gold. On one side, the 5,000-year-old safe haven asset, gold, has quietly delivered a robust, low-volatility return for investors seeking refuge from global uncertainty. On the other, Bitcoin, often championed as “digital gold,” has once again proven its extreme risk profile, riding a massive wave of gains to a new high only to suffer one of its sharpest, most painful monthly corrections ever. While the headlines focus on the recent crypto crash, a look at the full 12-month scorecard reveals a fascinating contrast between high-octane growth and reliable preservation of wealth.

When comparing the performance of Bitcoin (BTC) and Gold (XAU) over the last year, you see a classic illustration of a high-risk, high-reward asset versus a traditional safe-haven asset.

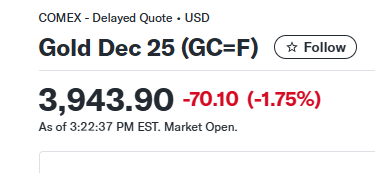

Here is a comparison of their performance and characteristics over the last 12 months (approximately November 2024 to November 2025):