Why the price of gold is hitting new highs

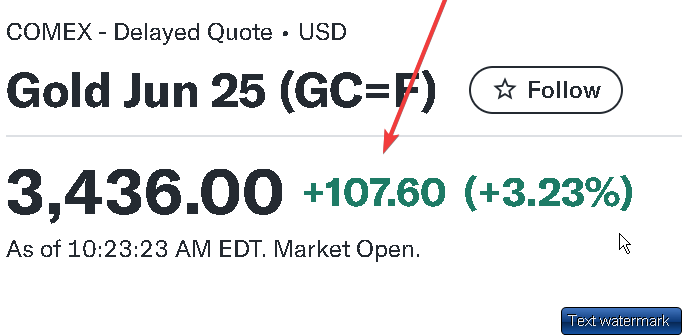

The price of gold has been hitting new highs for a confluence of reasons, reflecting a complex interplay of economic, geopolitical, and market factors. Here are the main drivers:

gold bars

Why the price of gold is hitting new highs

1. Geopolitical Tensions and Uncertainty:

- Tariff Wars: President Trump’s imposition of tariffs on various imports, particularly from China, has created significant uncertainty in global trade. This has led investors to seek safe-haven assets like gold to protect their capital. The on-again, off-again nature of tariff announcements further exacerbates market jitters.

- Broader Geopolitical Risks: Ongoing tensions in various parts of the world, including Eastern Europe and the Middle East, contribute to a risk-off sentiment. Gold is traditionally seen as a safe store of value during times of geopolitical instability.

- Central Bank Instability Concerns: Uncertainty surrounding the independence of central banks, such as President Trump’s plans to potentially overhaul the Federal Reserve, can weaken the dollar and boost gold prices.

- Economic Uncertainty and Recession Fears:

- Slowing Economic Growth: Concerns about a potential slowdown in global economic growth or even a recession increase the attractiveness of safe-haven assets like gold. Inflation Concerns: While inflation has moderated from its recent peak, there are still concerns about sticky inflation or a re-acceleration. Gold is historically considered a hedge against inflation and the devaluation of currencies.

- Stagflation Risks: Fears that the U.S. economy could enter a period of stagflation (slow growth with high inflation) further bolster the appeal of non-yielding assets like gold.

- Weakening U.S. Dollar:

- Gold is typically priced in U.S. dollars, so a weaker dollar makes gold cheaper for investors holding other currencies, increasing demand and pushing prices higher. Concerns about the U.S. budget deficit and the long-term trajectory of U.S. government debt can also contribute to dollar weakness.

- Central Bank Buying:

- Central banks around the world have been increasing their gold reserves. This trend accelerated after the freezing of Russian central bank assets in 2022. Many central banks, particularly in Asia, are diversifying their foreign exchange reserves away from the U.S. dollar, viewing gold as a reliable reserve asset amidst geopolitical and economic instability. This sustained demand from central banks provides significant support to gold prices.

- Investment Demand:

- Safe-Haven Flows: During times of market turbulence and uncertainty, investors flock to gold as a safe haven to preserve capital. This increased investment demand drives prices up. ETF Inflows: Gold-backed Exchange Traded Funds (ETFs) have seen significant inflows, indicating strong investor interest in holding gold. · Lower Interest Rate Expectations: Expectations that the Federal Reserve will soon shift to monetary easing and cut interest rates make non-yielding assets like gold more attractive compared to interest-bearing securities.

- Supply and Demand Dynamics:

- While mine production is relatively stable, increased demand from investors and central banks can outpace supply, leading to higher prices. The perception of gold as a finite resource and its historical role as a store of value contribute to its demand during uncertain times.

In summary, the recent surge in gold prices is driven by a confluence of factors, including geopolitical risks, economic uncertainties, a weakening dollar, strong central bank buying, and increased investment demand for its safe-haven properties. The interplay of these elements has created a bullish environment for gold, pushing it to new record highs.

Personally, as a recreational gold prospector, the consistent new highs that we’ve been seeing in the spot price of gold now has me somewhat concerned. I’m thinking even though there’s good reason for these increases, the spot price of gold has been increasing too fast and too consistently. Now, with many investors jumping on board, it may be a good time to play contrarian, and sell before a big dip occurs. Yes, I love to see new high gold prices, but with what’s been happening I would not at all be surprised to see a sharp dramatic drop below $3,000 an ounce, that’ll knock the majority of speculators out of the market.

Now, with that said who really knows? Maybe if we find that Fort Knox is missing a lot of gold, or a tactical nuke goes off in Ukraine, perhaps in the blink of an eye, we can see the spot price of gold hit $5,000!

Why the price of gold is hitting new highs

A real unique gift idea

- But, not just an ordinary gift, but a gift that could instill a lifelong Hobby and appreciation of The Great Outdoors as well as having the distinct possibility of appreciating in value over the years! Yes, I’m talking about giving real natural gold nuggets unique mineral specimens and authentic US silver dollars from the 1800s!

Morgan Silver Dollar & Gold Nugget

A good starting point would be our old west collection of U.S. silver dollars matched up with a natural gold nugget! Check it out at: https://california-gold-rush-miner.us/old-west-collections/

See the most expensive type of gold nuggets, the Crystalline Gold Nuggets

Crystalline gold

Subscribe to our Youtube Arizona Gold Prospecting channel

Click Here for great Gold Prospecting Equipment Deals

DISCLAIMER:

Some of the links in this description and in our videos may be affiliate links, and pay a small commission if you use them, but never increase the basic cost. I really appreciate the support. The content in my Youtube videos & blog posts SHALL NOT be construed as tax, legal, insurance, construction, engineering, health & safety, electrical, financial advice, prospecting or other & may be outdated or inaccurate; it is your responsibility to verify all information. I am a not financial adviser. I only express my opinions based on my experiences. Your experience may be quite different. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. You must conduct your own research. There is NO guarantee of gains or losses on any investments. My produced videos are for entertainment purposes ONLY. DO NOT make buying or selling decisions based on these videos. If you need advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer, financial advisor, or the appropriate professional for the subject you would like help with.

- Keep in mind land use and land boundaries are constantly changing, before going to a unknown location you must do extensive research not only into the current weather conditions, access and current land status. Keep In mind private property owners and mining claim owners do not take kindly to trespassers and or claim jumpers. Always follow local laws and regulations related to prospecting and land use. Regulations and restrictions are constantly changing on BLM lands, State lands, National Monuments and tribal lands. It is your responsibility to totally investigate any potential prospecting area prior to heading out. Failure to do so, could not only result in massive fines but also imprisonment and confiscation of all your equipment.

0 Comments