Gold’s Recent Volatility: A Correction After A Stellar Rally

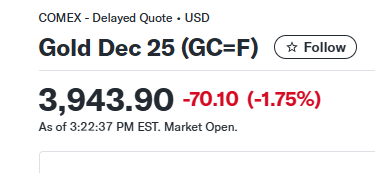

The spot price of gold has experienced significant volatility in the past few weeks, moving sharply away from its recent multi-year or even all-time high. This movement is being widely viewed by analysts not as a bubble bursting, but as a necessary and overdue corrective phase following an explosive rally.

Gold’s Recent Volatility

The Factors Driving the Pullback

The key drivers of the recent price depreciation—which has seen gold settle into a consolidation range near a major psychological support level (around $4,000 per ounce, according to recent reporting)—are rooted in a shift in macroeconomic sentiment. A strengthening US dollar has been a major headwind, as it makes dollar-denominated gold more expensive for foreign buyers.

Expert Outlook: Short-Term Uncertainty, Long-Term Bullishness

Looking forward, expert consensus points to a period of continued short-term volatility and range-bound trading.

The Unwavering Long-Term Case

Despite the near-term technical correction, the long-term structural outlook for gold remains fundamentally bullish for many market experts.

Gold’s Recent Volatility

Visit our gold prospecting site to view of collection of natural gold nuggets,

silver and many other unique precious metals collectibles and great gift ideas:

https://california-gold-rush-miner.us

A few examples from our site:

High Grade Silver Ore Slab

silver slab – example only

Nice sawn vein specimen of fresh, unaltered high grade silver ore from the world-class Cobalt Ontario deposits. Sawn on one side only. The deposit was described in Mineralogical Record, Volume 43, Number 6. In general, veins are predominantly composed of carbonates (calcite and/or dolomite) with arsenides and sulpharsenides of Co, Ni and Fe with native Ag and Bismuth. Most of this material has been squirreled away in collections by now, although specimens do occasionally come to market.

There are a few of these silver slabs available. The very bright silver really makes this piece stand out, but, unfortunately makes it all so hard to photograph. As an example the one pictured above is 66 grams for $45.

Silver, Bornite

There are a few of these beautiful native silver w bornite specimens available. Here is a 2 inch x 1 inch, Apx. 17.5 grams – Native Silver on Bornite thumbnail specimen from San Martin, Mexico. As an example the one pictured above is 17.5 grams for $60.

Avon Gold Rush Collectible stein

1987 8 1/2” tall San Francisco Gold Rush Handcrafted in Brazil for Avon. Each one of is individually numbered (#32017) this is the last one. $35.

For further information on these: seo711@gmail.com

All the items shown here are very limited and subject to prior sale without notice.

#######

Also see the most expensive type of gold nuggets, the Crystalline Gold Nuggets

Crystalline gold

Subscribe to our Youtube Arizona Gold Prospecting channel

Click Here for great Gold Prospecting Equipment Deals

DISCLAIMER:

Some of the links in this description and in our videos may be affiliate links, and pay a small commission if you use them, but never increase the basic cost. I really appreciate the support. The content in my Youtube videos & blog posts SHALL NOT be construed as tax, legal, insurance, construction, engineering, health & safety, electrical, financial advice, prospecting or other & may be outdated or inaccurate; it is your responsibility to verify all information. I am a not financial adviser. I only express my opinions based on my experiences. Your experience may be quite different. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. You must conduct your own research. There is NO guarantee of gains or losses on any investments. My produced videos are for entertainment purposes ONLY. DO NOT make buying or selling decisions based on these videos. If you need advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer, financial advisor, or the appropriate professional for the subject you would like help with.

- Keep in mind land use and land boundaries are constantly changing, before going to a unknown location you must do extensive research not only into the current weather conditions, access and current land status. Keep In mind private property owners and mining claim owners do not take kindly to trespassers and or claim jumpers. Always follow local laws and regulations related to prospecting and land use. Regulations and restrictions are constantly changing on BLM lands, State lands, National Monuments and tribal lands. It is your responsibility to totally investigate any potential prospecting area prior to heading out. Failure to do so, could not only result in massive fines but also imprisonment and confiscation of all your equipment.

0 Comments