Gold Price Appereciation

Gold Price Appereciation

As of December 5, 2025, the spot price of gold has significantly outperformed the S&P 500 and the Dow Jones Industrial Average, while standard CD interest rates have seen a downward trend.

As of December 5, 2025, the spot price of gold has significantly outperformed the S&P 500 and the Dow Jones Industrial Average, while standard CD interest rates have seen a downward trend.

Here’s a breakdown of how I see the recent drop in gold prices — whether it looks like a pullback, a rout, or a buying opportunity — along with what the market consensus appears to be.

Gold recently peaked above US $4,300/oz before dropping ~2 % (or more) in a short span, after hitting a record high.

The drop is attributed to a combination of:

A firmer U.S. dollar (makes gold more expensive in other currencies)

Some easing in safe-haven demand (for instance, comments from U.S. leadership around trade with China)

The fact that gold is now “overbought” in many analysts’ views, suggesting a technical correction might be underway.

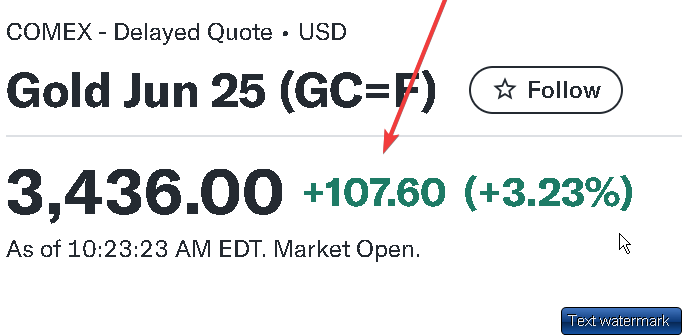

Based on the latest available data, the spot price of gold has experienced a significant jump today and has seen a substantial increase year-to-date.

Jump in Gold Price

Gold prices reached an all-time high today, with the spot price for one troy ounce climbing to over $3,530. This surge is attributed to several key factors:

(more…)

PEOPLE WILL LOSE THEIR GOLD & SILVER Ray Dalio explores the hidden forces shaping the future of gold and silver. As global economic shifts accelerate, most people will lose their precious metal holdings without even realizing why. This video uncovers the economic mechanics, market patterns, and systemic triggers that will Read more

The price of gold has been hitting new highs for a confluence of reasons, reflecting a complex interplay of economic, geopolitical, and market factors. Here are the main drivers: (more…)

Gold prices are rising, up 8.5% year to date, fueled by tariff uncertainty and increased purchases by central banks and investors.

gold price 2025

People choose to buy gold for various reasons, such as it’s historical role as a store of value and medium of exchange, it’s potential as a hedge against inflation or currency devaluation, Plus, it’s relative scarcity compared to other commodities. (more…)

Investing in Gold

In 2024, both gold and the S&P 500 have experienced significant growth, with gold slightly outperforming the S&P 500.

As of early November 2024, gold has seen a year-to-date increase of around 17-18%, while the S&P 500 has gained approximately 17-18%.

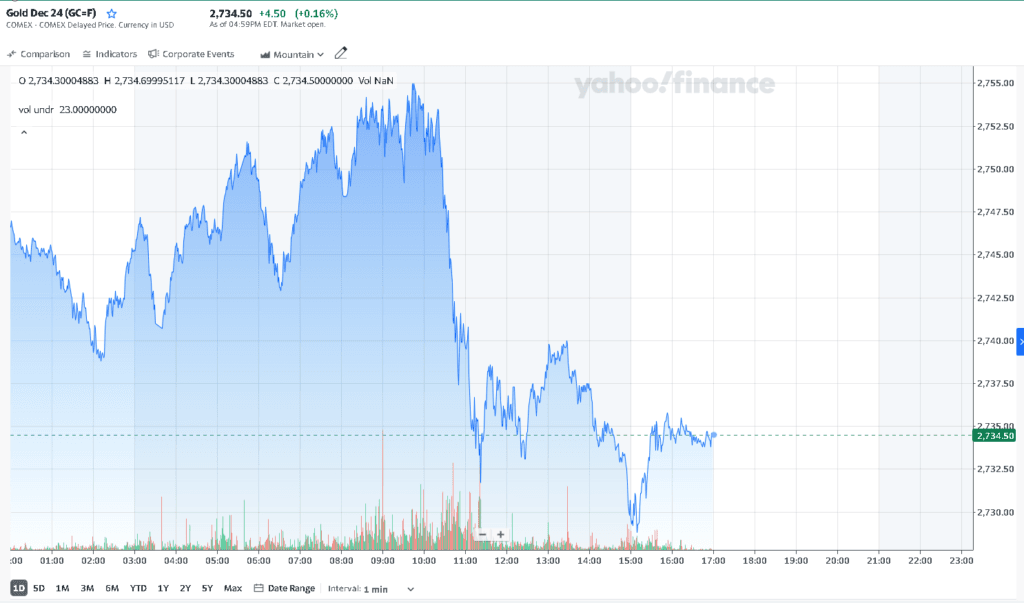

Even with an afternoon consolidation, both the Futures gold price and silver price hit new highs today!

The Silver futures spot price briefly hit $34 per ounce, the highest level in 12 years before paring gains. (more…)

The consensus on the value of gold is a bit mixed right now (March 30th, 2024).

As of yesterday, March 28th, 2024, the spot price of gold was around $2,234.10 per troy ounce. (more…)

Many central banks all around the world own gold. In fact, since the late 90s, central banks around the world have been net buyers of gold.

That wasn’t true before that. Coincidentally, that is also when the gold price bottomed ended that long bear market and began a massive, epic bull-market leading into a bubble in the late 2000s. (more…)

Bloomberg recently published a piece called, ‘The Gold Market’s Great Migration Sends Bullion Rushing East.’

The article notes that China has imported 160 TONS of gold since April, India has added 80 tons, Turkey 62, and the list goes on. Is the U.S. — or other Western nations — selling gold to China? And if so, why wouldn’t we be buying it, instead? (more…)

Just a few days ago I published a post and a chart showing that this week the spot gold price hit its lowest level in the last 2 years.

gold bars

I found this amazing when one considers all the turmoil in the world especially in Ukraine and Taiwan. If you’d like to see that post here’s the link:

https://california-gold-rush-miner.us/gold-price-3/ (more…)

In our videos, we talk about the economic collapse and the market crash that has taken over the world. We point out the situation on the real estate and stock market and the value of the US dollar. On the Life Success Story channel, you will learn about the work of Central Banks, the US Federal Reserve, and measures taken by the Government.

Speakers such as Robert Kiyosaki, Ray Dalio, Jim Rogers, and Peter Schiff teach you about the billionaire mindset and point out the importance of financial education. (more…)