Silver Cost Paper vs. Physical: The Real Cost of Silver in 2026

Silver Cost

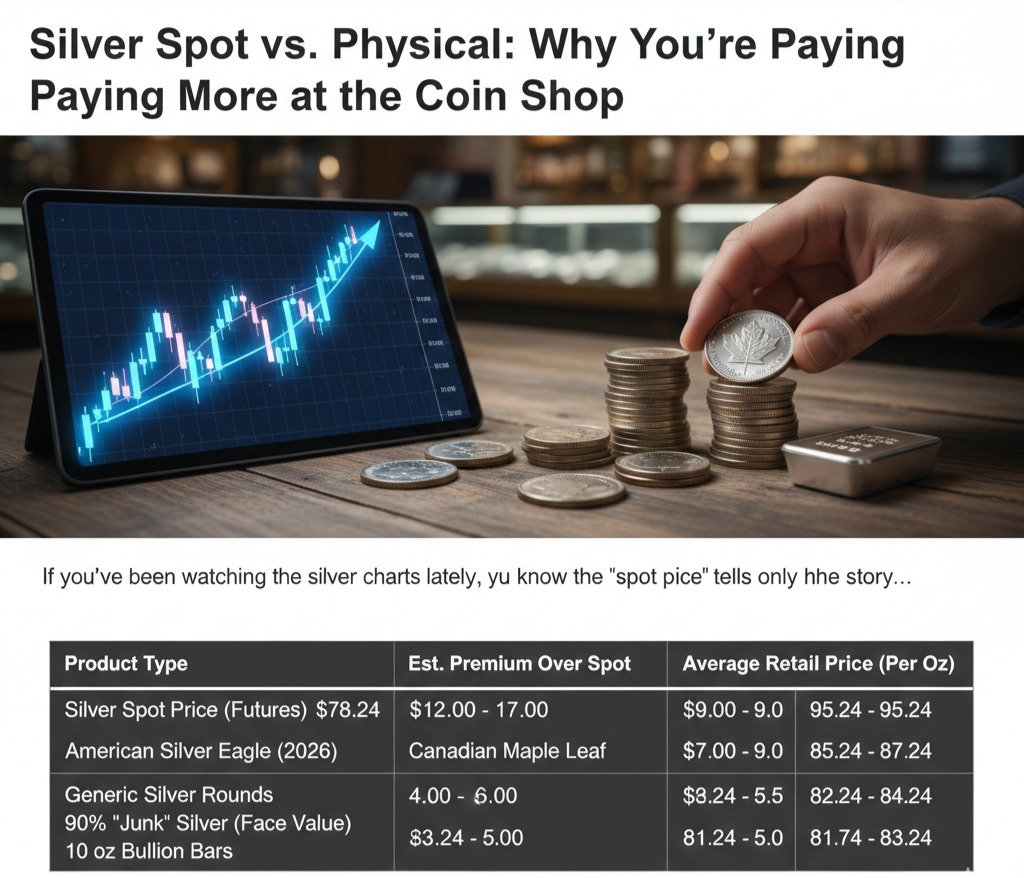

If you’ve been watching the silver charts lately, you know the “spot price” tells only half the story. While the COMEX futures market reflects the digital value of silver contracts, anyone walking into a local coin shop quickly realizes that “spot” is more of a suggestion than a reality.

Silver Cost Paper vs. Physical

Currently, we are seeing a massive disconnect. With the silver market in its sixth consecutive year of deficit and global supply chains remaining tight, the premium—the extra amount you pay over spot for the physical metal—is where the real action is.

Why the Gap?

The futures price (paper silver) is often driven by institutional trading and industrial outlooks. However, the physical market is driven by retail demand. When supply at the mints can’t keep up with the number of “stackers” wanting to hold the metal in their hands, premiums skyrocket. This is especially true for sovereign coins like the American Silver Eagle, which currently carries the highest premium in the market.

Current Market Pricing Breakdown

Below is a snapshot of what you can expect to pay at a typical coin shop versus the current futures baseline.

Note: Prices are based on a spot price of $78.24 and may vary by dealer and quantity purchased.

The “Golden” Strategy

For investors, the goal is often to get the most “ounces for the buck.” While Silver Eagles offer the most recognition and liquidity, the premiums can eat into your potential profits. If you are looking to hedge against inflation with the lowest entry cost, generic rounds and 10 oz bars remain the most efficient way to stack physical silver in today’s volatile market.

Disclaimer: This post is for informational and entertainment purposes only. It is not financial, investment, or legal advice. Precious metals prices are highly volatile and can change dramatically. Past performance does not predict future results. Always do your own research, consult a qualified financial advisor, and never invest more than you can afford to lose. The author is not responsible for any decisions based on this post.

Silver Cost Paper vs. Physical

Avon Gold Rush Collectible stein

1987 8 1/2” tall San Francisco Gold Rush Handcrafted in Brazil for Avon. Each one of is individually numbered (#32017) this is the last one. $35.

For further information on these: seo711@gmail.com

All the items shown here are very limited and subject to prior sale without notice.

#######

Also see the most expensive type of gold nuggets, the Crystalline Gold Nuggets

Crystalline gold

Subscribe to our Youtube Arizona Gold Prospecting channel

Click Here for great Gold Prospecting Equipment Deals

DISCLAIMER:

Some of the links in this description and in our videos may be affiliate links, and pay a small commission if you use them, but never increase the basic cost. I really appreciate the support. The content in my Youtube videos & blog posts SHALL NOT be construed as tax, legal, insurance, construction, engineering, health & safety, electrical, financial advice, prospecting or other & may be outdated or inaccurate; it is your responsibility to verify all information. I am a not financial adviser. I only express my opinions based on my experiences. Your experience may be quite different. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. You must conduct your own research. There is NO guarantee of gains or losses on any investments. My produced videos are for entertainment purposes ONLY. DO NOT make buying or selling decisions based on these videos. If you need advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer, financial advisor, or the appropriate professional for the subject you would like help with.

- Keep in mind land use and land boundaries are constantly changing, before going to a unknown location you must do extensive research not only into the current weather conditions, access and current land status. Keep In mind private property owners and mining claim owners do not take kindly to trespassers and or claim jumpers. Always follow local laws and regulations related to prospecting and land use. Regulations and restrictions are constantly changing on BLM lands, State lands, National Monuments and tribal lands. It is your responsibility to totally investigate any potential prospecting area prior to heading out. Failure to do so, could not only result in massive fines.

0 Comments