Gold Price

Russian invasion creates extreme volatility for gold and silver prices.

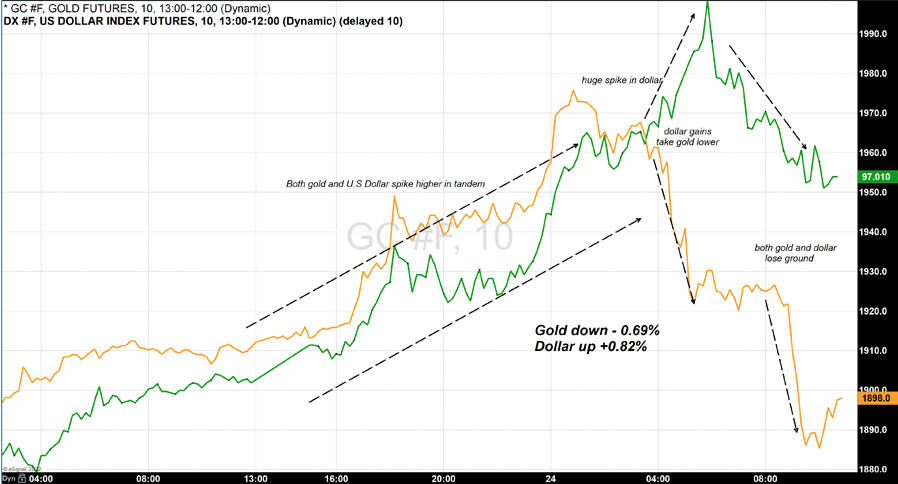

Gold prices today witnessed a volatile roller coaster with a tremendous price swing of almost $100 over the last 18 hours of trading.

Gold Price

gold price swing

Gold futures for the most active April contract traded to a high of $1976.50 during the initial hours of trading immediately following the Russian invasion and then traded off to a low of $1878.60 before recovering.

As of 4:45 PM, today, gold futures were currently fixed at $1905.40, a net decline of five dollars on the day. I do not recall such a tremendous price swing in one day for both gold and silver.

Even with today’s tremendous volume and you huge price swings in the spot gold and silver prices, some believe the whole precious metals complex has signaled a major breakout.

From Wikipedia, the free encyclopedia:

Gold has been used throughout history as money and has been a relative standard for currency equivalents specific to economic regions or countries, until recent times. Many European countries implemented gold standards in the latter part of the 19th century until these were temporarily suspended in the financial crises involving World War I. After World War II, the Bretton Woods system pegged the United States dollar to gold at a rate of US$35 per troy ounce. The system existed until the 1971 Nixon Shock, when the US unilaterally suspended the direct convertibility of the United States dollar to gold and made the transition to a fiat currency system. The last major currency to be divorced from gold was the Swiss Franc in 2000.

Since 1919 the most common benchmark for the price of gold has been the London gold fixing, a twice-daily telephone meeting of representatives from five bullion-trading firms of the London bullion market. Furthermore, gold is traded continuously throughout the world based on the intra-day spot price, derived from over-the-counter gold-trading markets around the world

Like most commodities, the price of gold is driven by supply and demand, including speculative demand. However, unlike most other commodities, saving and disposal play larger roles in affecting its price than its consumption. Most of the gold ever mined still exists in accessible form, such as bullion and mass-produced jewelry, with little value over its fine weight — so it is nearly as liquid as bullion, and can come back onto the gold market. At the end of 2006, it was estimated that all the gold ever mined totaled 158,000 tonnes (156,000 long tons; 174,000 short tons).

Given the huge quantity of gold stored above ground compared to the annual production, the price of gold is mainly affected by changes in sentiment, which affects market supply and demand equally, rather than on changes in annual production. According to the World Gold Council, annual mine production of gold over the last few years has been close to 2,500 tonnes. About 2,000 tonnes goes into jewelry, industrial and dental production, and around 500 tonnes goes to retail investors and exchange-traded gold funds

#######

Be sure to view our Gold nuggets for sale.

View our Natural Silver specimens

Also see the most expensive type of gold nuggets, the Crystalline Gold Nuggets

Subscribe to our Youtube Arizona Gold Prospecting channel

0 Comments